Banking is changing because of new technologies and digital services. Open banking changes the role of a bank and opens new business opportunities and makes banking part of digital services ecosystem.

Open Banking

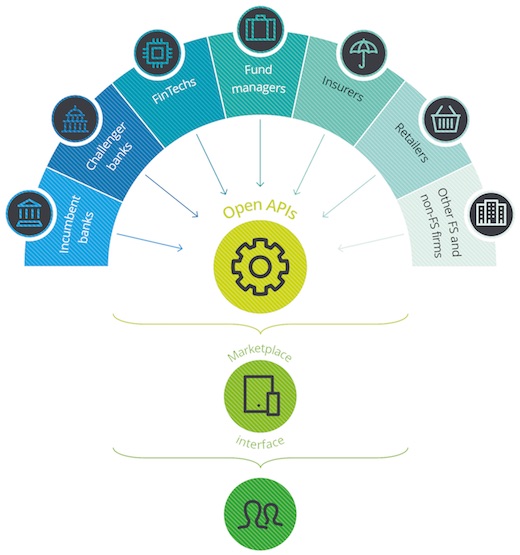

Open banking as a concept includes two major areas:

- Providing open APIs that enable development of services by 3rd party developers

- Enable 3rd parties an access to financial and customer data via open APIs

Typically, there are also open source or standard technologies used in development to make it transparent and extendable for the future.

Services are build using those APIs and they can be anything from account transaction analysis to mobile salary payment service implemented by a 3rd party developer. Some concepts also include an open marketplace for services and APIs developed using basic interfaces.

Access to APIs regulated so that financial and personal date is safe and secure. Also user needs to be identified on the service. This may be e.g. strong digital authentication on the mobile (e.g. bank’s own identification app).

Open banking APIs can be utilised by any trusted 3rd party, it might be a direct competitor or a retailer utilising some credit service provided by a bank. This means that open banking will expose banks to new competition but it also enables them to be part of global digital services ecosystem which will open new revenue stream opportunities.

PSD2 Directive in EU

European Union adopted 2015 a revised Payment Services Directive (PSD2). Banks have to open their payment services to other companies. This means third parties can access bank customer’s accounts and make payments on their behalf. The account holder will always have to give consent to use of personal data.

In practice this means that consumer can authorise e.g. mobile application to access his account balance and make payments directly from the account. PSD2 will be in effect by Jan 2018 and after that we will see first live consumer services developed on open banking APIs.

Open Banking Examples

For example, Finnish-based Nordea Bank as opened own open banking initiative. It provides developer environment, testing sandbox and the bank is supporting developers with documentation and testing.

Spanish BBVA bank has also very good site for their open banking initiative, BBVA Open 4U. There are developer resources and lots of articles available. Some ready-made APIs are available via market place here. They also have demo application online.

Most of the big banks have already published their open bank initiatives and developer programs during 2017. It is exciting to see all those new services that will be available to consumers and businesses next year!

Read more about our salary payment platform: